Our book, High Returns from Low Risk: a remarkable stock market paradox, has been available for sale since the beginning of January 2017. We are very satisfied that the book grabbed the attention of investors from all over the world as we’ve highlighted in previous blog-posts. After the summer we expect some more momentum by introducing the book in other languages as well.

In the English and German book we demonstrate the powerful and remarkable results of investing 100 USD in a portfolio consisting so-called ‘Conservative stocks’ and the results of investing a similar amount of money in a portfolio consisting high-risk stocks, the so-called Risky portfolio. Both portfolios started on the 1st of January 1929 and the book demonstrates the evolution of both portfolios until the first of January 2015. The different graphs, illustrations and tables shown in the book provide a clear message: low-risk beats high-risk when investing in equities.

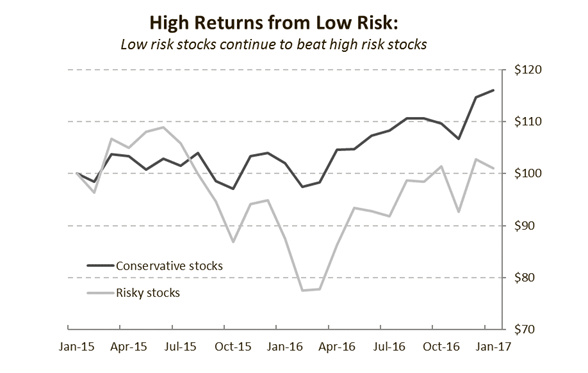

During 2015 and 2016 we have kept ourselves busy by writing and publishing the book. In the book we promised our readers to inform them once we’ve updated the dataset. As of today readers of the book are able to download and access the updated dataset covering the period January 1929 – January 2017 (password protected, the password can be found in the book in Chapter 15 and equals the third word in the first sentence of this chapter). This updated dataset includes the monthly returns of the ten volatility-sorted portfolios for the years 2015 and 2016. As can be seen in the graph Conservative stocks continue to beat Risky stocks over the last two years.